How to create 1 crore worth asset with an initial investment of Rs 25 Lakh

Share How to create 1 crore worth asset with an initial investment of Rs 25 Lakh

When it comes to investing, the most important question before us is – Where to invest? The traditional investment options like gold and fixed deposit are no longer lucrative. Stock market/mutual funds are highly volatile and risky to invest.

Then, what will be an option for those who are looking for a potential investment, which is ever appreciating but risk- free? The answer is real estate. Let’s see how you can invest in real estate with a minimum initial investment.

Let’s assume, you’ve shortlisted an apartment, worth one crore. Your down payment will be Rs. 25 lakh. Usually, banks or other housing finance companies will provide you up to 75 percent of loan amount. In effect, you have owned a property worth one crore with Rs. 25 lakh, which is an ever-appreciating asset.

It is a proven fact that the value of real estate investment will increase over time. For example, the launch price of Skyline Springfield Villa at Cochin was Rs. 12 lakh, it has now appreciated to Rs. 2.1 crore. Likewise, the launch price of Skyline Palm Meadows Villas at Kottayam was Rs. 29.8 lakh, it has appreciated to Rs. 1.42 crore. Another project at Calicut, Skyline Medows, was priced at Rs.7.5 lakh during its launch; it has now appreciated to Rs.1.05 crores.

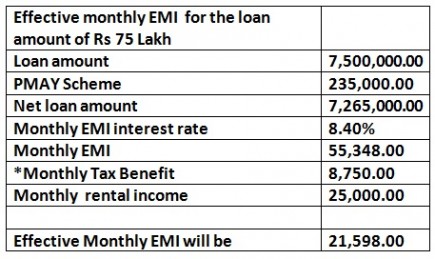

You can claim income tax benefit of Rs. 1.50 lakh for the principal repayment and an annual interest up to Rs 2 lakh can be claimed as a deduction against income. Along with this under Pradhan Mantri Awas Yojana (PMAY)), you will get a subsidy of Rs. 2.35 lakh.

Pradhan Mantri Awas Yojana

For best locations, the average rental income increases, usually in the range of five to ten percent. A steady rental income will help you partially fund to repay the loans taken. In effect, your effective EMI will come down drastically.

The table attached in images illustrates your effective monthly EMI for a property worth one crore. The down payment is taken as Rs. 25 Lakh.

But, all these are possible if you invest with the right right builder. It is very important to check the builder’s expertise and track- record. Always choose a builder with a good reputation, who gives priority for best locations, quality of construction, timely delivery, financial stability and above all, it should have an efficient post-sales service team. This will guarantee that you get a good return on your hard-earned money.

*If your yearly income is above 10 lakh, the tax slab applicable will be 30%

*Yearly tax benefit under 80 cc is Rs. 1.5 lakh

*Yearly Tax Benefit under section 24 is Rs. 2 Lakh

* Total Yearly tax benefits is Rs. 3.5 lakh

* Loan tenure is 30 years

Article by Skyline Builders

Request a Call Back