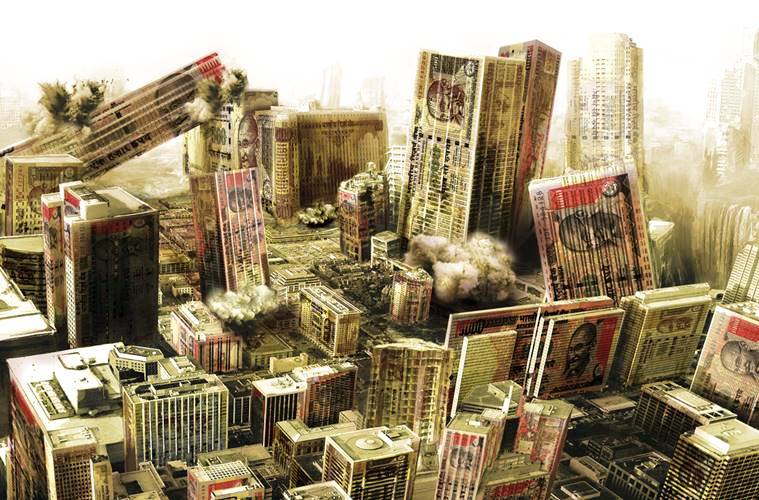

Realty Sector gets Bittersweet Taste of Demonetisation

Share Realty Sector gets Bittersweet Taste of Demonetisation

A year on since demonetisation, we reflect upon the year of reforms and the way forward for the real estate sector.

Business sentiments in the modern history of real estate in India have hit the rock bottom. While sentiments are largely transient in nature, the prevalent mood in the industry reflects the most matured opinion on the battery of reforms that became a reality over the past12-odd months.

It all started on November 8, 2016 when the government decided to derecognise high denomination currency. The first, in the slew of long-term reforms, took the industry by storm; however, it remained hopeful of brighter future. A few months later we saw another structural reform, the Real Estate (Regulation and Development) Act, 2016 come into effect. And, the final salvo in the reforms-driven new order was the roll out of the Goods and Services Act.

Despite widespread heartburns sparked off by each of these policy decisions the realty sector stayed optimistic. Today as we look back at the year since demonetisation it is clear that the industry has a much more objective view of the changing times. The real estate sector, in particular, has come to terms with the fact that buoyancy is unlikely to bounce back in the immediate future. Even the festive season that is known to bring in the occasional cheer has failed to scuttle the gloom.

The results of the latest FICCI - NAREDCO - Knight Frank Sentiments Index for the quarter ending September 2017 stand testimony to the somber scenario across the industry today.

This time the survey results assume higher relevance as it captures the industry mood nearly a year since demonetisation. In a nutshell the future sentiments score i.e. the outlook for the next six months has hit an all-time low over the past 39 months.

There is also an evident slowdown in the overall economy. Industry analyses of India’s business performances have seen a steady decline. Capital expenditure has dwindled to worrisome levels and growth is unlikely to revive in the near future.

Going forward It feels that the next 12 to 18 months are likely to be the ‘under observation’ period for the real estate sector. Industry stakeholders should spend the period in reorienting businesses in line with the new order. India’s strong economic fundamentals still puts it among the fastest growing economies in the world. The need of the hour is to put our heads down and allow the consolidation process to take its own due course.

Request a Call Back