Taxes and Duties: A Comprehensive Homebuyer’s Guide

Share Taxes and Duties: A Comprehensive Homebuyer’s Guide

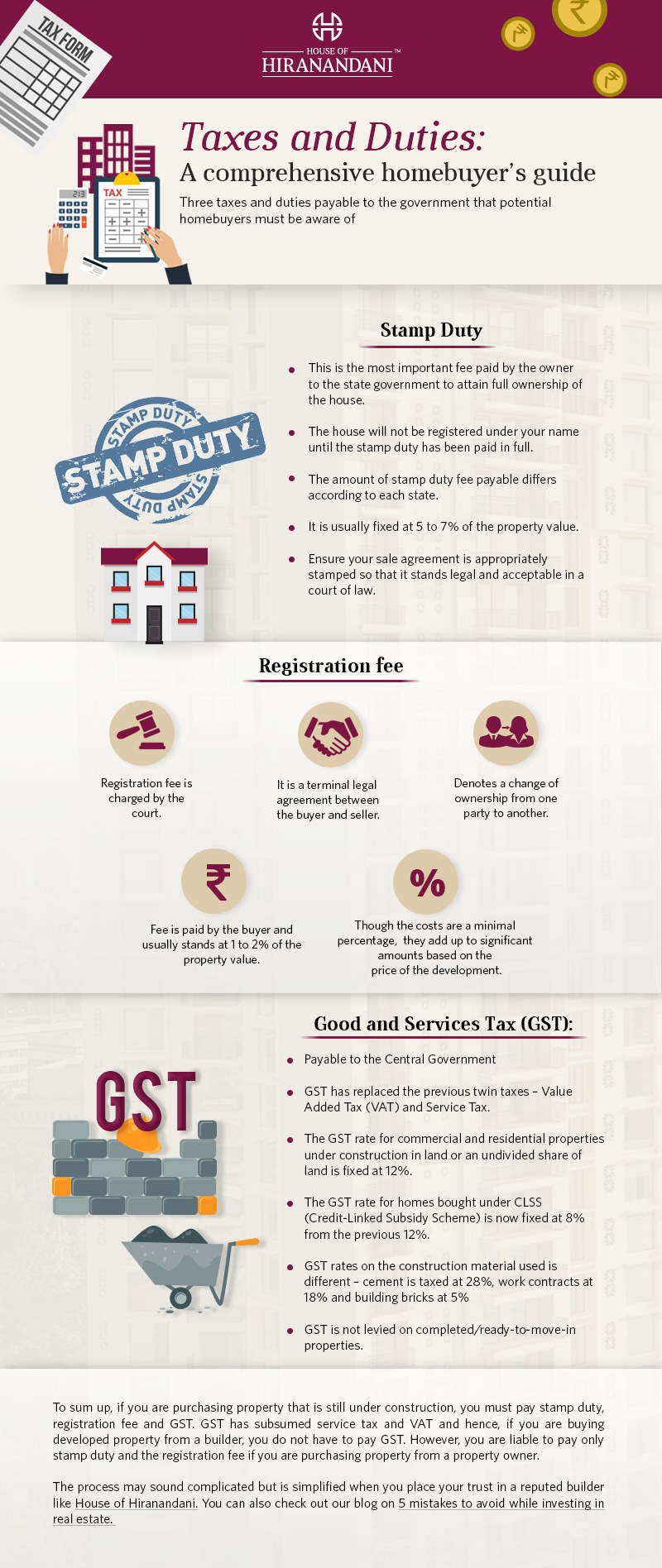

Taxes and Duties: A comprehensive homebuyer's guide. Three taxes and duties payable to the government that potential homebuyers must be aware of.

Stamp Duty:

- This is the most important fee paid by the owner to the state government to attain full ownership of the house.

- The house will not be registered under your name until the stamp duty has been paid in full.

- The amount of stamp duty fee payable differs according to each state.

- It is usually fixed at 5 to 7% of the property value.

- Ensure your sale agreement is appropriately stamped so that it stands legal and acceptable in a court of law.

Registration Fee:

- Registration fee is charged by the court.

- It is a terminal legal agreement between the buyer and seller.

- Denotes a change of ownership from one party to another.

- Fee is paid by the buyer and usually stands at 1 to 12% of the property value.

- Though the costs are a minimal percentage, they add up to significant amounts based on the price of the development.

Goods and Service Tax (GST):

- Payable to the Central Government.

- GST has replaced the previous twin taxes - Value Added Tax (VAT) and Service Tax.

- The GST rate for commercial and residential properties under construction in land or an undivided share of land is fixed at 12%.

- The GST rate for homes bought under CLSS (Credit-Linked Subsidy Scheme) is now fixed at 8% from the previous 12%.

- GST rates on the construction material used is different - cement is taxed at 28%, work contracts at 18% and building bricks at 5%.

- GST is not levied on completed/ready-to-moue-in properties.

To sum up, if you are purchasing property that is still under construction. you must pay stamp duty, registration fee and GST. GST has subsumed service tax and VAT and hence, if you are buying developed properly from a builder, you do not have to pay GST. However, you are liable to pay only stamp duty and the registration fee if you are purchasing property from a property owner.

Request a Call Back